[ad_1]

In 2016 Telesat made a bet that their future growth would rest with the idea of building a low Earth orbit satellite constellation which would become known as Lightspeed.

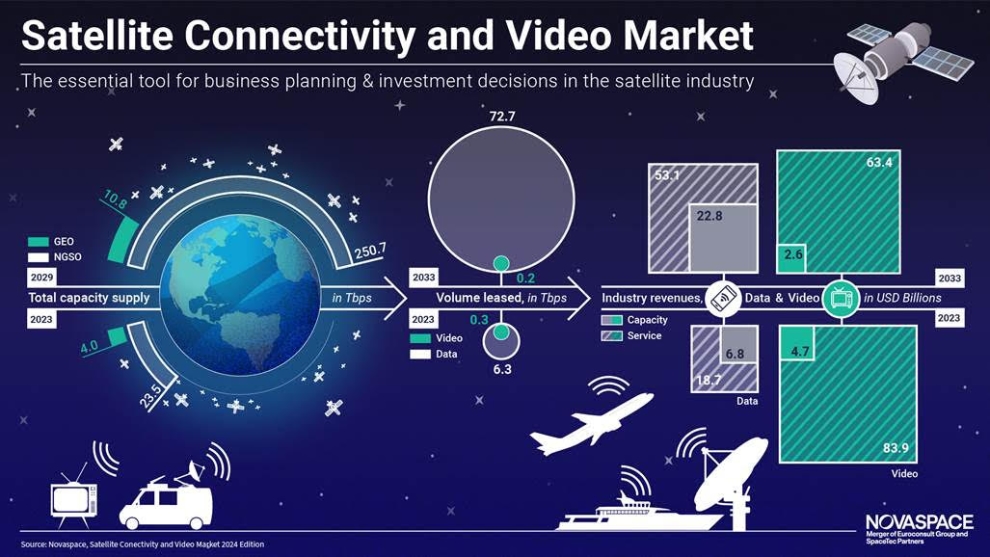

According to the latest Novaspace report on Satellite Connectivity & Video Market, the Non-Geostationary Satellite Orbit (NGSO) market, which includes Telesat’s Lightspeed, will see revenues surpass the geostationary orbit market in 2028. The bet Telesat made looks to pay off, though it’s taken much longer than expected.

Novaspace said “GEO capacity still represented around 85% of capacity revenues in 2023, though NGSO capacity revenues are projected to grow at a Compound Annual Growth Rate (CAGR) of 27%, surpassing GEO revenues by 2028 and wringing in around $18 billion by 2033.”

According to Novaspace “The past three years have seen a dramatic eightfold increase in global satellite capacity supply, reaching around 27 Tbps in 2023, a figure accounted for over 80% by Starlink. This dominance can be partially attributed to delays from initial target dates from most other constellation projects and software-defined satellites. However, new Low Earth Orbit (LEO) constellations such as Telesat Lightspeed, and Amazon Kuiper, alongside second-generation constellations for Starlink and Eutelsat OneWeb, and Very High Throughput Satellites (VHTS) like Viasat-3, are expected to drive growth to 260 Tbps by 2029.”

Satellite operators have been taking a “wait and see” approach with as NGSO systems increased and with Geostationary Earth Orbit (GEO) orders declining steadily.

Dimitri Buchs, Manager at Novaspace and lead author said, “Facing a shifting landscape marked by declining demand for video broadcasting, fluctuating mobility market patterns, and an influx of capacity from NGSO constellations, satcom operators have been exploring different strategies to survive.”””

“In order to expand market reach, diversify service offerings, and enhance business resilience, capacity providers have been increasingly forming ‘multi-orbit’ partnerships. Market segments with lower price sensitivity, such as aero In-Flight Connectivity (IFC) and military communications are expected to drive the majority of demand for multi-orbit connectivity solutions. Overall, multi-orbit service revenues are anticipated to reach nearly $5 billion by 2033.”

[ad_2]

Source link

No comments! Be the first commenter?